Preparing for Endgame – The World is turning Japanese

“We are facing an extremely difficult time, comparable in many ways to the 1930s, the Great Depression. We are facing now a general retrenchment in the developed world, which threatens to put us in a decade of more stagnation, or worse. The best-case scenario is a deflationary environment. The worst-case scenario is a collapse of the financial system.” ~ George Soros [Newsweek]

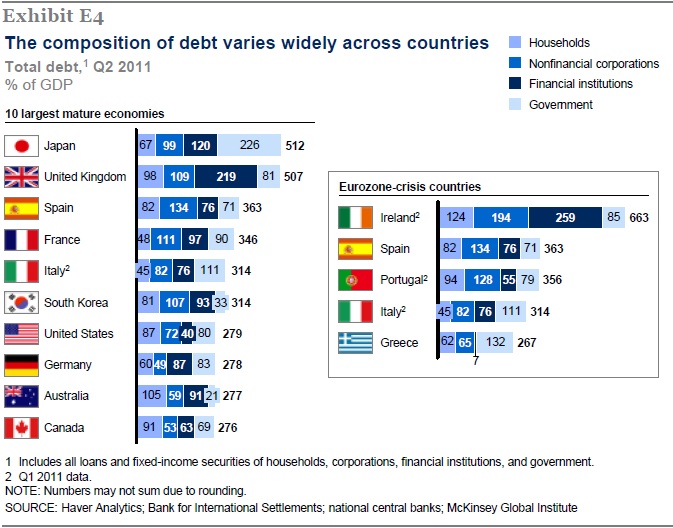

The most important economic graph of our times lays out the total debt of 10 largest mature economies.

The above graph should shock you. It shows a world at unprecedented levels of debt that are inherently unsustainable.

“Debt that can’t be paid, won’t be paid.”

The world as we know it is about to hit it’s endgame, where we stand on the edge of drastic change. Most of it motivated by recklessness in finance, backward economics and crippling self serving democracy. The likely scenarios are as follows.

- The European Union is at a real crossroads. Likely scenarios are…

- Europe federalizes (best scenario)

- Greece leaves, inflicting mayhem…and then Spain, Portugal, Italy may leave

- Germany alone leaves the EU, allowing the other countries to maintain a lower valued EU (2nd best scenario)

- Whatever happens in the EU, the fallout will most likely send Britain into oblivion. It’s so close there already with its astronomical debt.

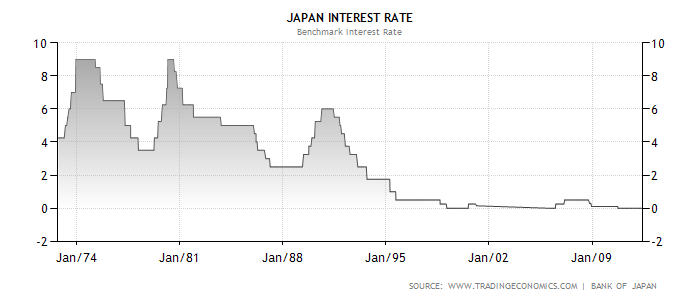

- Japan is on the verge of hitting a brick wall.

- The US also has its own host of fiscal problems, and the EU crises will also send shockwaves through it

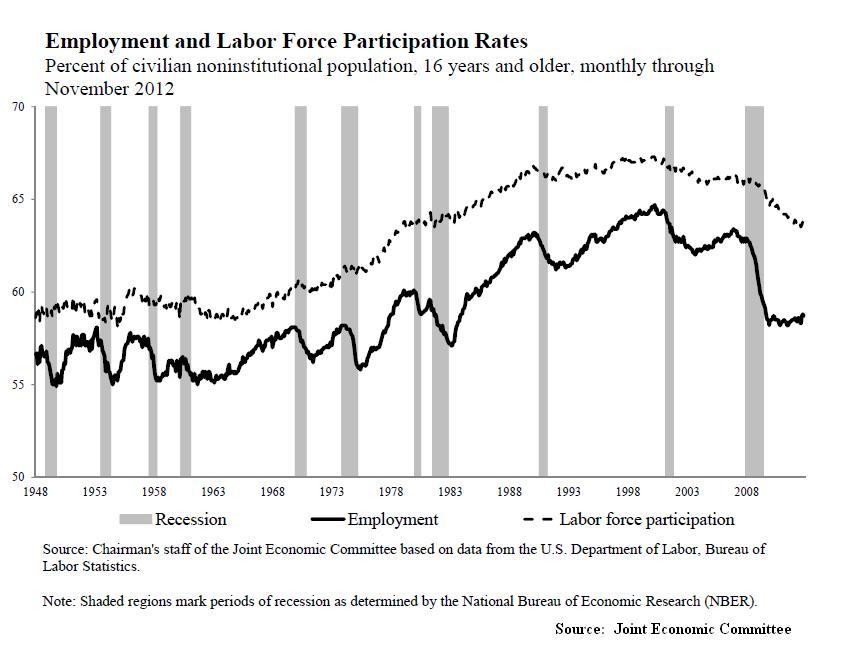

Austerity measures are being implemented across the globe, this will spike unemployment and begin the march towards a deflationary spiral. Central banks while averting total disaster, are making furture disaster even worse. The longer this drags on, the worse it will become.

The Big Numbers – How this Impacts Global markets

- The Global Bond market is worth an estimated ~160 trillion

- The Global Equity (stock) market is worth an estimated ~55 trillion

- The Global Hedge Fund (derivatives) market is worth an estimated ~ 2 trillion

(source)

Notes from George Soros INET talk:

- Economics tried to imitate Newton’s physics. It sought to establish timeless laws governing reality

- Economics is a social science that have thinking participants who base their decisions on imperfect knowledge.

- Natural phenomena has facts. Social science by contrast has subjective participants with considerable bias which gives rise to unpredictability. Social science does NOT have LAWS or FACTS.

- Perfect competition is based on perfect knowledge……which again most people don’t have.

- The future can’t be known until it has occurred.

- Karl Popper – “Peoples interpretation of reality never quite corresponds to reality to itself.”

- Reflexivity – Reality is not something independently given. Guess work is always required because decisions about future.

- Fallibility and Reflexivity. <——-Two fundamental Siamese twin like points.

- George Soros has ignored modern economic theory…that is an indictment in of itself.

- Bubbles are endogenous to financial markets, NOT an exogenous shocks. Positive feedback loop. Which becomes unsustainable. Bubbles are asymmetric. Busts happen quick, booms more slowly.

- Magnitude and duration of bubbles are unpredictable. Timing is key for investing.

- Financial markets tend towards financial crises, and bubbles.

- its misleading to study financial market sin isolation. politics is tightly intertwined, in a time bound context.

- Th idea that laws or models can predict the future needs to be abandoned.

- Interactions of Social Philosophy, Politics & economics based on imperfect markets and imperfect authorities.

- Boom, bust cycle.

- The recognition of fallibility far from being paralysing & depressing is actually empowering because what fallibility implies, is the capacity for improvement.

The outcome – Massive Financial Inequality

#41) The bottom 40 percent of all income earners in the United States now collectively own less than 1 percent of the nation’s wealth. (source)

#28) In 1950, the ratio of the average executive’s paycheck to the average worker’s paycheck was about 30 to 1. Since the year 2000, that ratio has ranged between 300 to 500 to one.

http://voices.washingtonpost.com/ezra-klein/071410-snapshot.jpg

Debt of Nations

“These debt projections combine with a recent study that debt over 77% of GDP slows GDP growth. So Japan’s 197% debt ratio is reducing GDP growth by almost 2% per year. So once a nations debt is around 277%, there is a 3.4% annual reduction in GDP growth and nation is stuck in economic stagnation combined with other large debt problems. ”

http://nextbigfuture.com/2010/09/debt-of-nations.html

again:

http://nextbigfuture.com/2010/09/national-debt-beyond-77-of-total-gdp.html