I have been doing a lot of research on investing and finance lately and have come across a lot of information that is extremely concerning and shocking. The global economy is in much worse shape than I had originally thought and Canada while regarded as a safer place than the USA appears to be in just as bad fiscal shape! It appears the global economy is headed straight down the toilet for the next decade or so due to a massive accumulation of un-payable debt.

What sparked a lot of this off is watching the Crash Course series on Chris Martenson’s website. Mr. Martenson spent several years dedicated to figuring out how the fiscal economy works and how money is created and spent. Crash Course is for the lay person and I highly recommend watching it.

Without getting to technical the fundamental problems seem to be rooted in:

- Fractional Reserve Lending

- Economic models and Fiscal Banking Models predicated on perpetual growth

- Fatal flaws in Keynesian/Milton-Friedman/free market capitalist models of the economy that DON’T take into account private/buisness/gov’t debt

- Banks being leveraged out the wazoo, typically in excess of 30:1

- interest payments are tax-deductible in most countries

- Governments encouraged mortgages

- Currency not backed by anything….such as gold (our currencies are fiat)

- Terrible regulation on part of governments on how loans are made…which led to speculative asset bubbles

- Reckless consumer, corporate government spending, racking up huge debts that are un-payable

- Our Democratic Political system…Politicians constantly increasing spending and cutting taxes, and the greedy voters that put them there

What this spells out is large systemic collapse of the global economy in the near future. Nearly all democratic developed nations are at fault for racking up massive debt. Socialist governments spend to much on social programs…Conservative governments spend to much on their Military.

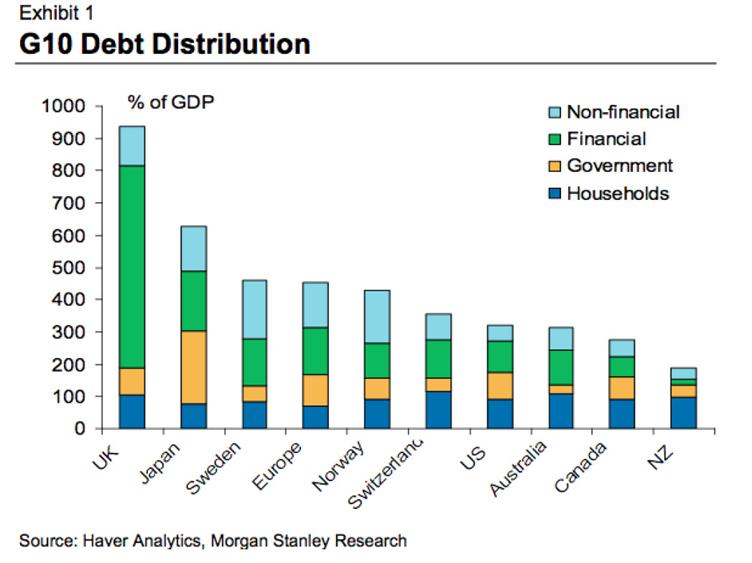

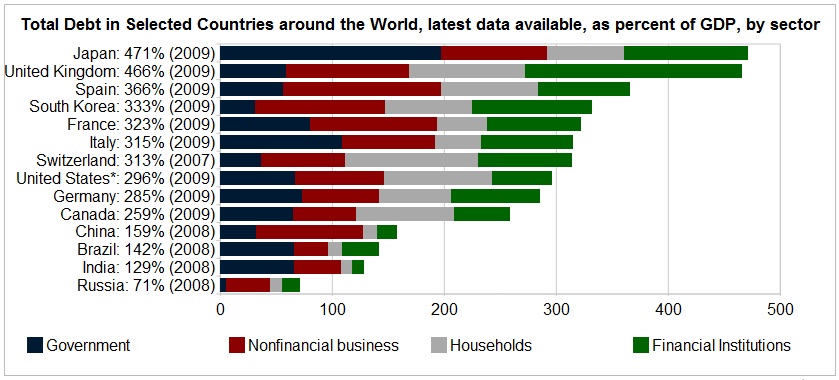

The Numbers:

Figuring out how much debt nations have and what debt numbers are actually relevant seems to be an ardours task, that most people including 90% of economists out there know nothing about. Next time you see a Banker or a Finance person or an economist ask them what the total debt of a nation is. They probably have no clue! There are 4 levels of a nations debt I am primarily concerned with:

- Federal Government Debt

- Provincial/State/Municipal Level Debt

- Consumer/Private/Household Debt

- Business (Corporate) Debt

Combing the above levels of debt will give you a Nation’s total debt. A number very few people seemingly know for any nation. Let’s look at the debt numbers for a few select countries. Absolute numbers will also be compared to GDP and other ratios for a rough guestimate for the ease of paying debts off.

Federal (National) Government Debt:

- USA ~15.1 trillion

- European Union ~ 14 trillion

- Canada ~ 575 billion

- Australia ~ 142.7 billion……29% of gdp

- Singapore ~ 223 billion….. (102% of gdp)

- New Zealand ~ 41 billion

Provincial/State/Municipal Government debt:

- USA ~ 1.2 trillion

- Canada ~ 1.2 trillion

Consumer/Private/Household Debt:

- USA ~ 16 trillion

- Canada ~ 1.537 trillion

- Norway household debt as a % of disposable income 204%

Business/Corporate Debt:

- USA ~ ?

- Canada ~ 1.27 trillion

- Australia ~ 682 billion

Combined Total Debt:

- UK …………………………………total debt to GDP is 950%

- USA ~ 56 trillion……………… total debt to GDP is 300%- 365%

- New Zealand ~ 450 billion….total debt to GDP is 337%???

- Canada ~ 4.6 trillion…………. total debt to GDP is 283%

What does this all mean? It appears the global economy is on the verge of a systemic collapse. The goal for me now is to try and figure out how the whole thing will come down and what the best way is to prepare for it. When governments are having a difficult time paying the interest on their debt and getting their credit rating downgraded you know we are in serious trouble.

Another aspect to this is Central Banks are keeping interest rates super low. By keeping interests rates low they are ENCOURAGING people to take on MORE debt, since loans are so cheap! The effect of this is that it also PUNISHES people & corporations that SAVE. The net effect is that it rewards people who are reckless with money and penalizes those that are prudent. This is what happens when you try to stimulate a debt choked economy by creating more debt! Central banks are doing their best to run the economy into the ground FASTER.

The primary root problem is that society – Governments, People & Businesses are in massive amounts of un-payable debt. Two possible outcomes occur when debt cannot be paid off:

- Defaulting on debt…going bankrupt. Money disappears into thin air. People & businesses run the highest risk of defaulting. This causes deflation.

- Paying off debt by printing more money out of thin air. Governments can do this and they can also bail out people/businesses via handouts to banks. This causes inflation.

“Inflation reduces the real value of money over time; conversely, deflation increases the real value of money – the currency of a national or regional economy.” ~ Wikipedia

Inflation & Deflation will be the primary metrics that define the future of the global economy over the next several years. So the big question is….with all the debt having no hope of being able to be paid off, will the currency of a given country deflate or inflate?

The crazy thing about all of this is how the crises is being managed. As the economy takes a downturn, central banks are lowering interest rates making it easier for people to borrow money in hopes of stimulating the economy. The effect is the debt load gets increased dramatically. As the debt goes up, and people start defaulting banks require bailouts which is more debt. And the cycle continues. Banks aren’t held accountable for the loans and especially mortgages are insured by the government plus they are to big to fail. Thus banks have virtually no incentive to giving out less loans. In fact its just recently been made more lucrative. This exacerbates the problem of continuous debt piling. Oh there is a cliff up ahead and were heading straight for it…!!? I know….lets step on the gas!!

The way I see it there are 4 likely possible scenarios. From worst to best they are:

- Global hyperinflation or a deflationary spiral destroys the global economy and results in total Anarchy – we return to the Dark Ages. Start growing your own food & get a bow and arrow. Move somewhere warm.

- Prolonged serious pain on a level much worse than the last great depression as economies fight to restructure themselves over the next 5-20 years. (battling high rates of either deflation or inflation)

- A new global currency & financial government is introduced that solves all the current systemic problems (http://www.cmn.tv/news/new-world-currency/) &/or a Parallel Monetary System

- Aliens land and save us all from ourselves

Check out my next 2 posts on what may happen and how to prepare:

Sources: